What the 2025 Budget Means for Students, Apprentices & Professionals

What does the budget mean for you?

One of the most eagerly-awaited Budgets in living memory, the Chancellor's (or should we say the OBR's) announcement has brought with it a mix of fresh opportunities and tough decisions - especially for students, apprentices, and those starting out in their careers.

So, if you’re studying, working an apprenticeship, or simply trying to figure out what’s next, there are some big changes that are worth knowing about.

Apprenticeships & Skills: A Boost for SMEs and Young People

One of the standout points from the Budget is a move to fully fund training for apprentices aged under 25 at small and medium-sized businesses (SMEs). The move will see the 'co-investment' cost for employers, especially for apprentices in the 22–24 age bracket, scrapped, removing one of the barriers that may have been holding back smaller employers from bringing in fresh talent.

So, if you're an apprentice or someone considering that path, this could open doors:

It might make employers more willing to take on apprentices now that training is 'free'.

For SMEs, bringing on an apprentice becomes a lower-cost, lower-risk way to add energy and new ideas to their team.

Overall, there’s potential for a skills boost across the economy, especially in sectors where hands-on learning really matters.

If you’re not sold on traditional uni life, or want something more practical and work-oriented, this could be a good time to give an apprenticeship some serious consideration.

Higher Education, International Students & What’s Changing

For the higher education sector, Rachel Reeves' plans will see the introduction of a new levy on the income universities in England receive from international students. Set to come into force in the 2028/29 academic there are a number of exemptions:

Levy-free allowance: Providers will receive an allowance for their first 220 international students each year, which is equivalent to exempting approximately £200,000 of levy liability.

Targeted institutions: The exemption is designed to reduce the burden on smaller or specialist institutions.

Provider type: Only English higher education providers, including those registered with the Office for Students, are subject to the levy.

Course level: The levy only applies to international students studying a higher education course (level 4 and above). Students on further education courses at a higher education provider are exempt.

Exemptions for further education: Further education providers who are not registered with the Office for Students are not subject to the levy.

What does this mean for domestic students?

Well, on one hand, the move is part of a government plan to channel more support toward domestic students, possibly via reinstated maintenance grants for low-income or disadvantaged students on certain 'priority courses.'

This could mean less reliance on loans and more real financial support - which is a welcome shift if you’re juggling university costs and living expenses, however this is speculative at the moment.

What does this mean for universities?

For universities (especially those that rely heavily on international student fees), this adds financial pressure - a pressure that could translate into difficult choices around funding, fees, or resources. That might affect future students, particularly international ones.

It feels very much like a 'watch this space' to see the real impacts the new levy will have on the sector.

What does the budget Mean for Professionals, Lifelong Learners & Early-Career Journeys

The Budget isn’t just for students and apprentices - it sends signals to career starters, lifelong learners, and those thinking about switching paths too:

With a renewed 'skills-first' angle, things like apprenticeships, short courses, and technical training may start to look more attractive compared to traditional routes. Employers may be more open to hiring and training junior staff, which could benefit anyone looking for internships, entry-level roles, or a career pivot.

If you’ve skipped uni, or didn’t enjoy it, there might be a growing space for real-world learning and skill building, especially in sectors where practical skills matter (tech, trades, crafts, green energy, etc...).

Minimum wage increases

From April 2026. The National Living Wage, the minimum wage rate for all workers aged 21 and over, will rise by 4.1% to £12.71. The minimum wage for 18-20 year olds will increase to £10.85 and the rate for 16-17 year olds will increase to £8.00, seeing more money in the wage packets of anyone currently earning the minimum wage.

Even with the freezing of the tax-free allowance at £12,750 per year until the 2030-31 tax year, it is estimated that someone working a 40 hour week at minimum wage will see roughly an extra £700 a year in take-home pay although for higher earners, this will likely lead to 'fiscal drag' as inflationary pay rises push more people into higher income tax brackets.

Private Pensions

While it may not be top of your list of concerns, it's worth mentioning that from April 2029, salary-sacrifice pension contributions will be limited so that only the first £2,000 each year is exempt from National Insurance. While this reform reduces a major tax advantage, increasing NI costs for higher earners, it does keep basic pension saving incentives intact and simplifies long-term rules for most affected workers.

Budget Overview

This Budget feels like more than just numbers - it could mark a subtle shift in how the UK views education, training and early career paths. Instead of 'uni or bust', there’s growing room for flexibility, skills, work-based learning, and real-world experience.

If you’re a student, apprentice, or early-career professional: this might be a moment to step back, take stock, and think strategically about your options.

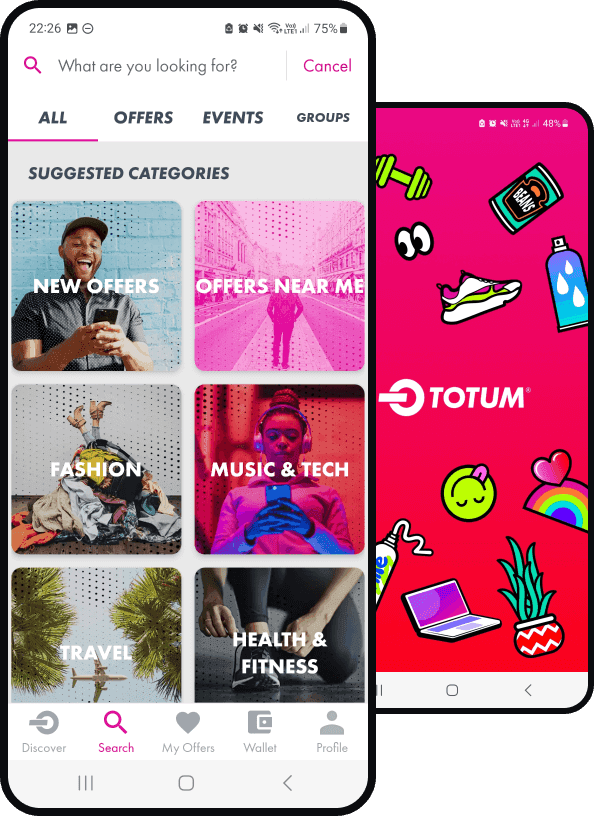

If you’re part of the TOTUM community, use the tools and savings available to you to navigate changes with confidence.

Join the TOTUM club!

Join TOTUM Student for FREE to access hundreds of student discounts on big-name brands like ASOS, Apple, MyProtein, boohoo, Samsung, and more!

Sign up for FREE, download the TOTUM app, and enjoy the latest offers, vouchers, coupons and more at your fingertips. Find out more.

Download The TOTUM App

Stories like this

The Ultimate Student Discount Showdown: TOTUM vs. Student Beans vs. UNiDAYS – Which Is Truly the Best?

Welcome to the definitive guide on navigating the world of student discounts. If you're a student in the UK, your inbox and social media feeds are likely bombarded with offers from various platforms promising to save you money. - find out which is best!

The Professional’s Guide to the ‘Salary Stretch’: Why TOTUM+ is the Secret Weapon for Public Sector and Professional Workers

While many discount schemes offer a few percentage points off occasional purchases, TOTUM+ is built around daily utility. The core proposition is simple: Save an average of £550+ per year for an initial investment that starts from just £14.99.

The Apprentice Advantage: 7 Essential Ways Your TOTUM+ Card Protects Your Budget During a Second Career

Taking the leap into a second career via an apprenticeship is a courageous and brilliant move. At 30, 35, or beyond, you are bringing years of professional experience, maturity, and a clear vision to your new path - TOTUM can support you on your journey.