Best Student Bank Accounts 2025: How To Open A Student Bank Account

Off to university this year and ready to open a student bank account but don't know where to start? Here are some of the UK banks with the best student account perks in 2025...

Starting university can be one of the most exciting times in your life, but it also comes with new responsibilities such as managing your own finances…

Thankfully, many banks in the UK offer bank accounts tailored to students to make your financial journey smoother, however you may be wondering which student bank account is right for you and how you ought to decide between them all…

From Lloyds and Santander to NatWest and Halifax, it can feel a little overwhelming trying to decide which bank you should open a student account with, so we’re here to talk you through the advantages of each.

What is a student bank account?

If you’re new to the world of student banking and don’t quite understand what differentiates a student account from any other current account, we’ve got you.

A student bank account is essentially a type of account designed specifically for those in higher education and comes with a number of perks to help you whilst you’re studying.

Becoming financially independent and learning how to budget can be a really challenging process, but you’ll find that many student bank accounts offer certain perks to help you throughout your time at university.

What are the benefits of a student bank account?

This largely depends on the bank you decide to open an account with, however generally speaking you can expect some of the following perks with a student bank account:

An interest-free overdraft for a certain time period

Freebies such as a railcard

A cash incentive for opening the account

How to open a student bank account

To open a student bank account in 2025, you’ll need a few things to confirm your status as a student in the UK.

It’s a relatively straightforward process, but you’ll likely need to meet the following eligibility criteria:

You must typically be aged 18 or over, although some banks may let you open a student account from the age of 17

You must prove that you are enrolled on a higher education course at either a college or university

You have a UK address

To prove this, you’ll usually be required to bring different forms of ID and documents that verify you’re eligible, such as:

One or two forms of photo ID such as your passport and/or driving licence

Your university/college acceptance letter or UCAS offer letter outlining that you have been enrolled onto a specific course

Proof of your address such as a recent utility bill or bank statement

Which is the best student bank account in 2025?

It’s impossible to provide a definitive answer on who offers the best student bank account in 2025, as some things are bound to be more important to some people than they are to others. However, check out the table below for an overview of what the different banks have to offer to students.

You can then check out the details for our top five student bank accounts in the UK further down the page!

Bank Account | 0% Overdraft | Main Incentive |

|---|---|---|

Up to £2,000 | Free 4 year 16-25 Railcard | |

Up to £3,250 | Free 4 year tastecard | |

Up to £3,250 | Free 4 year tastecard | |

Up to £3,000 | Potential £100 cash | |

Up to £3,000 | None | |

Up to £2,000 | Up to 15% cashback offers | |

Up to £2,000 | None | |

Up to £1,500 | 5% AER (Variable) interest | |

Up to £1,500 | Up to 15% cashback offers | |

Up to £1,500 | None |

Santander Edge Student Current Account

Moving up the rankings this year, we had to put Santander's updated student offering at the top of the charts. With a decent interest free overdraft (although not the most generous) and a host of other perks, it's definitely worth considering...

Advantages of the Santander Edge Student Bank Account:

With Santander, most students will get a 0% overdraft of £1,500 in years one to three, increasing to £1,800 in year five and £2,000 in year five for those with extended courses.

However, one of the main perks of the Santander Edge Student Bank Account is that you’ll receive a free 4-year 16-25 Railcard worth over £100 helping you to save ⅓ on rail travel across the country. This is a huge selling point for students who will be commuting or regularly travelling home by train, as the average 16-25 Railcard holder saves on average £190 per year on rail fare!

There are also Travel Benefits included with your Santander Student Account. There's no fees for using Santander cash machines when you travel abroad to a whole variety of countries including Spain, Germany, Poland, Portugal, Argentina, Brazil, Chile, Mexico, Puerto Rico, Uruguay, and the USA. Just make sure you pay in the local currency to avoid being charged any other fees!

Other perks of the Santander Edge Student Bank Account include Santander 'Boosts' which offer all sorts of things including cashback, vouchers, prize draws and personalised offers.

Santander Edge Student Current Account eligibility criteria:

To be eligible for a Santander Student Bank Account, you must be aged 18 or over, live in the UK permanently, and be studying or about to begin an undergraduate course that is at least 2 years in length, or a level 4 to 7 apprenticeship.

You’ll also have to make sure you pay at least £500 into your account every four months.

NatWest

Advantages of the NatWest Student Bank Account:

You’ll start with a guaranteed £500 0% overdraft which you can request to increase after your first term to £2,000 and then to £3,250 after second year, making this easily one of the most generous student bank accounts with regards to overdraft allowance.

The main incentive offered with the NatWest student bank account is a free four year tastecard membership (worth up to £79.99) that you can use for all sorts of discounts on dining out.

NatWest Student Bank Account eligibility criteria:

To open a NatWest student account, you must be at least 17 years old, have been living in the UK for three years or more, and be on a full-time UCAS-accredited undergraduate course of 2+ years, a full-time post-graduate course, or training to be a nurse.

Royal Bank of Scotland

Advantages of the RBS Student Bank Account:

Essentially the same as what is on offer from NatWest, the RBS student bank account offers you an initial guaranteed £500 0% overdraft. You can request to increase this to £2,000 after your first term and into your second year. From third year, students can apply for a 0% overdraft of £3,250.

The main incentive offered with the RBS student bank account is a free four year tastecard membership (worth up to £79.99) that you can use for all sorts of discounts on dining out.

RBS Student Bank Account eligibility criteria:

To apply, you must be 17+ and have been living in the UK for at least 3 years. Online applications only.

To confirm that you are a Student and eligible for this account, you must provide your unique 16 digit UCAS code. Courses without a UCAS code are not eligible for our student account.

You need to be a full time undergraduate Student (on at least a 2 year course at a UK University/College) or nursing course lasting a year or more. You can apply within 6 months of your course start date.

You must use your Student account as your main account by depositing your wages or other regular income into it.

HSBC

Advantages of the HSBC Student Bank Account:

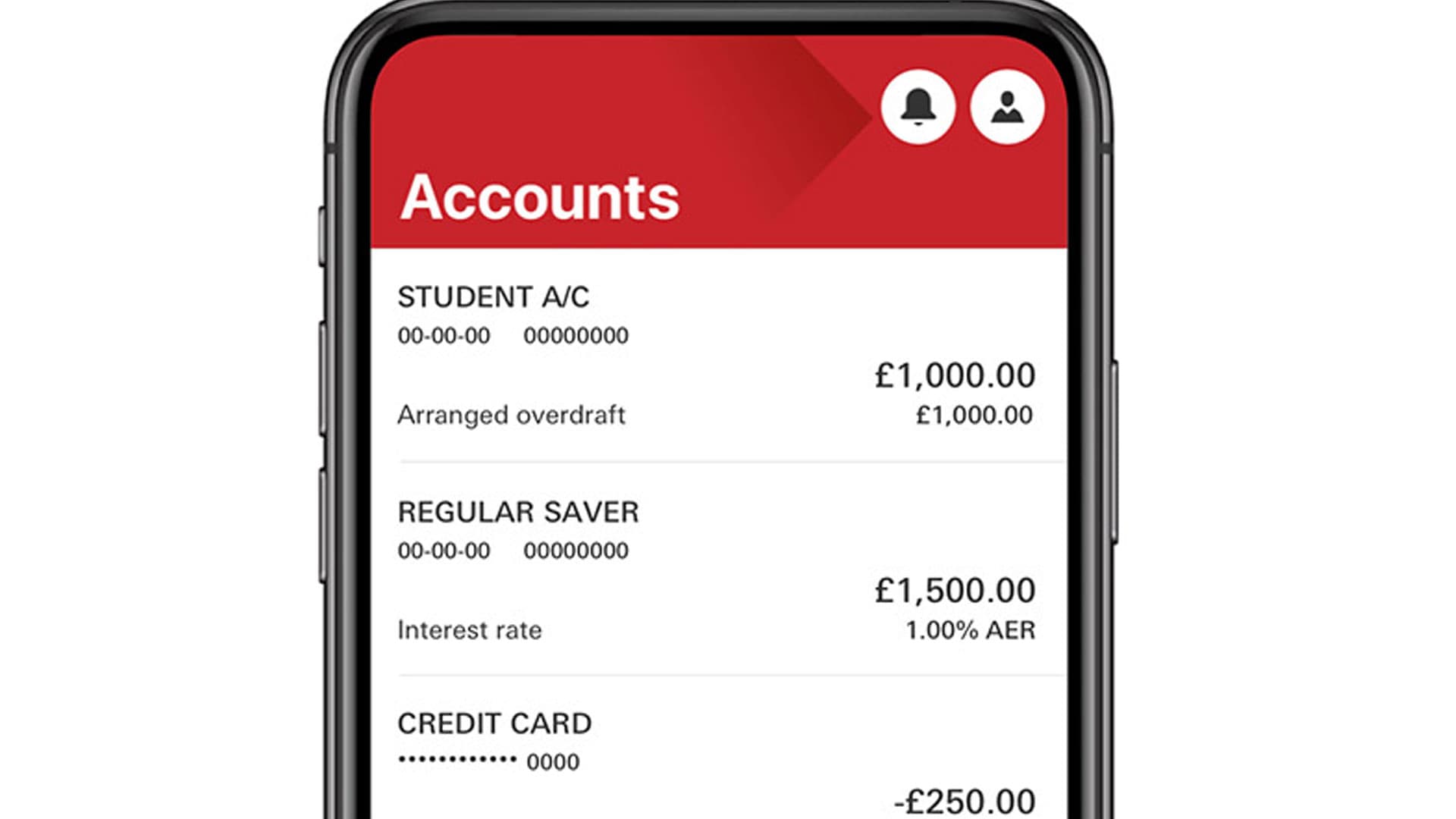

HSBC is renowned for offering one of the largest student bank account overdrafts in the country, with all students able to get a £1,000 0% interest overdraft in year one, rising to up to £3,000 in year three.

Other perks of HSBC’s Student Bank Account include:

In the past, HSBC has offered £100 cash just for opening a student account, however in 2025 this is no longer the case.

Access to HSBC's 5.00% AER Savings Account - if you're going to have a little bit to put away each month, you won't do much better than 5% interest anywhere else!

HSBC Student Bank Account eligibility criteria:

You can open a HSBC Student Bank Account if you're aged 18 or over, live in the UK and have lived in the UK, Channel Islands or Isle of Man for the past 3 years and have proof that you've been accepted onto a qualifying course.

Nationwide

Advantages of the Nationwide FlexStudent Bank Account:

Nationwide’s FlexStudent account offers a generous 0% overdraft of £1,000 in year one, £2,000 in year two and up to £3,000 in year three, though it’s important to note that these increases depend on your credit history.

With Nationwide, you can also be awarded £100 if you open a savings account with them as well. For the last 2 years running, Nationwide has given what they call a £100 'Fairer Share Payment' to all their eligible members - including those who have a FlexStudent account as their everyday account and £100 in savings with Nationwide.

It is important to note that they can change the eligibility criteria and the payment is not guaranteed. Nationwide say the payment is dependent on 'how well they perform financially', but do say it is their intention to make a payment every year.

Nationwide Student Bank Account eligibility criteria:

To qualify, you’ll need to be 18 or over, have been a UK resident for three years or more and have enrolled on a full-time UCAS registered course of 2+ years. It’s important to note you can only apply up to five months before or up to one year after your course starts.

Can you have multiple student bank accounts?

Usually, the terms and conditions of your account will state that you cannot open multiple student bank accounts. It’s typically a condition of receiving the perks of a student bank account that you’ll use this as your primary account, paying your student loan into the account.

Save money during university with TOTUM

Need help with budgeting as a student? TOTUM Talks is here to offer you all the best tips, tricks and advice on everything from money management throughout university to quick and easy student recipes, uni outfit inspo and more…

As a TOTUM member, you’ll make huge savings on pretty much everything, from travel and fashion to entertainment and groceries.

Join the TOTUM club!

Join TOTUM Student for FREE to access hundreds of student discounts on big-name brands like ASOS, Apple, MyProtein, boohoo, Samsung, and more!

Sign up for FREE, download the TOTUM app, and enjoy the latest offers, vouchers, coupons and more at your fingertips. Find out more.

Download The TOTUM App

Stories like this

The Ultimate Student Discount Showdown: TOTUM vs. Student Beans vs. UNiDAYS – Which Is Truly the Best?

Welcome to the definitive guide on navigating the world of student discounts. If you're a student in the UK, your inbox and social media feeds are likely bombarded with offers from various platforms promising to save you money. - find out which is best!

The Apprentice Advantage: 7 Essential Ways Your TOTUM+ Card Protects Your Budget During a Second Career

Taking the leap into a second career via an apprenticeship is a courageous and brilliant move. At 30, 35, or beyond, you are bringing years of professional experience, maturity, and a clear vision to your new path - TOTUM can support you on your journey.

What the 2025 Budget Means for Students, Apprentices & Professionals

If you’re studying, working an apprenticeship, or simply trying to figure out what’s next, there are some big changes that are worth knowing about.

_(1).png%3Fw%3D500%26q%3D60&w=3840&q=75)