Student Finance Payment Dates 2025/26: What Date Is The Maintenance Loan Paid?

Wondering when you'll receive your student finance payments in 2025/26? Here's how you can find out when you'll receive your maintenance loan.

Want to find out when your student loan will come in? Here are the student finance payment dates for the 2025/26 academic year...

For university students in the UK, nothing beats student loan day.

If you've applied for student finance, you'll receive one lump sum of money known as a maintenance loan at the beginning of each term. These will be your student finance payment dates, which we'll dive into below...

You may want to note these payment dates down so that you can keep track of when you should receive your maintenance loan payments this year and budget accordingly.

What is a maintenance loan?

The maintenance loan is a form of financial support offered by the government to university students.

Students receive three instalments of the maintenance loan throughout the academic year, typically within a few weeks of the start of each term. It’s designed to help with day to day living costs such as food, toiletries and home essentials, as well as rent and utilities.

So, as tempting as it might be to splash the cash on a whole new wardrobe and daily meals out, you’re going to want to spend it wisely and budget accordingly!

As the name suggests, the key thing to remember about the maintenance loan is that it’s just that - a loan - meaning you’ll have to pay it back eventually.

But remember, it’s repayable only once you’re earning a certain income - this is currently £28,470 a year, £2,372 a month or £547 a week in the UK for those on Student Loan Plan 2 (which is anyone who started their course between 1st September 2012 and 31st July 2023).

You’ll only pay back 9% of the amount you earn over the salary threshold, but there are different rates depending on which plan you're on, which we explain below.

How is student loan calculated?

The maintenance loan payments you receive as part of your student loan will vary depending on your personal circumstances, or more specifically the circumstances of your household.

Key factors taken into account to determine how much a student may receive in maintenance loan payments include:

Household income

Course start date

Where you live while studying

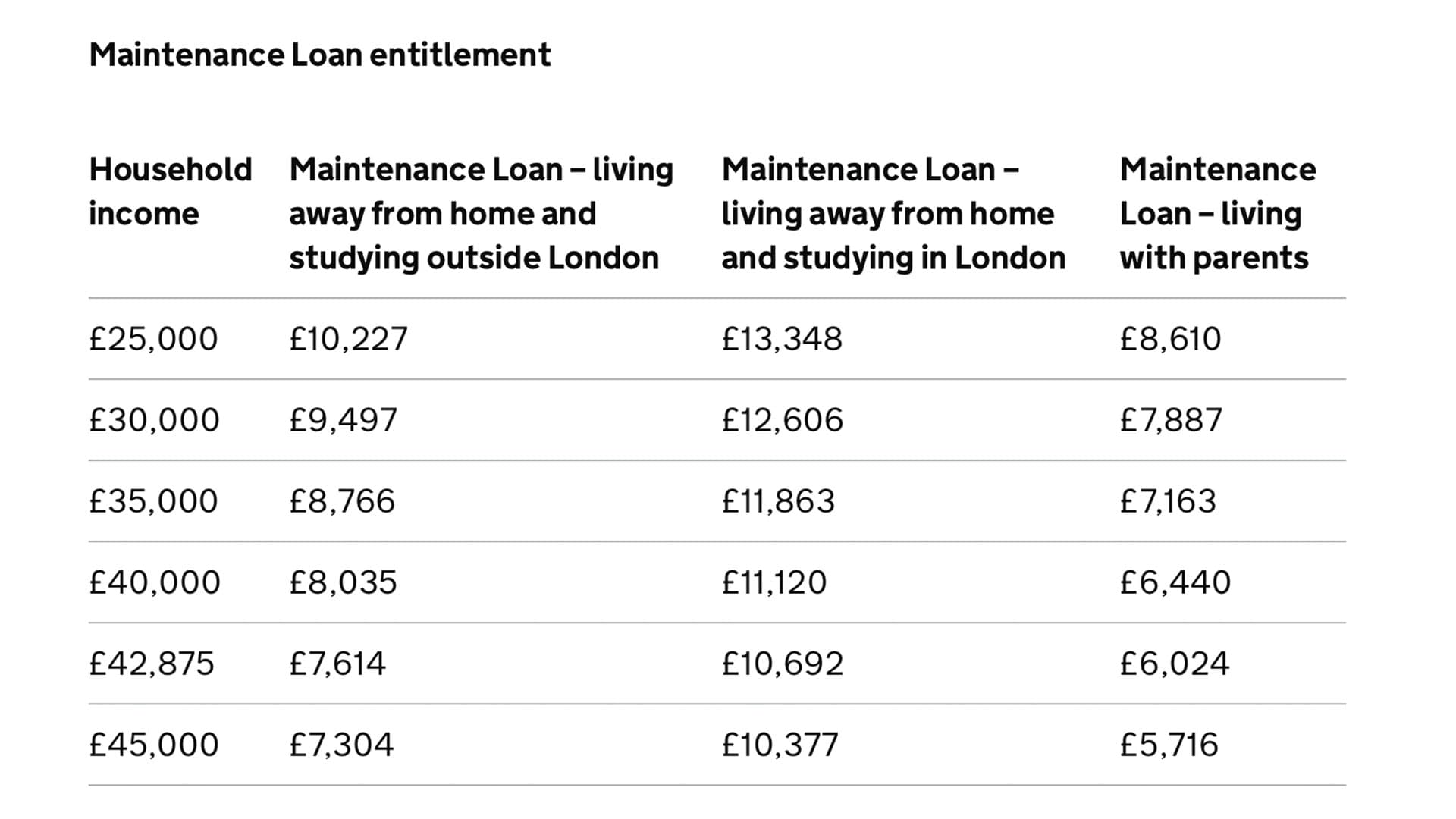

As per the Gov UK website, the below table outlines how much student loan you may receive depending on your age, whether you live with your parents or are set to live independently whilst studying, whether you rely on them financially and more.

In terms of your tuition fee loans, full-time students in England can get up to £9,250, or up to £11,100 if you’re studying an accelerated degree course. This money will be paid directly to your university, so you won’t personally receive this.

Student finance for part-time students

If you’re a part-time student, it’s worth noting that the process is a little different.

You may be eligible for a maintenance loan if your part-time course has what is known as a ‘course intensity’ of 25% or more. This can be determined by comparing your own module credits with the number of module credits a full-time student will study.

When it comes to your tuition fee loan, you can expect to get up to £6,935 in an academic year - but again, this will go directly to your university.

When do I get my student loan 2025/26?

Your maintenance loan payments will arrive in three instalments - with your annual allowance split roughly into three - and you’ll receive one at the beginning of each term.

This will largely be around the same time for each university, however the exact student finance payment dates may vary slightly.

For the next academic year (2025/2026), you can expect to receive your first maintenance loan instalment at the end of September/beginning of October to coincide with the start of the new term - but remember you won't receive your first maintenance loan payment until you’ve registered at your university or college - so make sure to do that as soon as you can after arriving!

You should then receive your second maintenance loan payment at the start of January 2026, while your final instalment will arrive at the start of April 2026.

When does the April student loan come in?

The next student loan drop will be at the beginning of April 2026. While there is no set date, you can expect to receive your April student finance payment within the first couple of weeks of the month. Again, the exact dates vary by university.

Remember, you'll only receive the maintenance loan - the tuition loan will go straight to your university. Students will receive differing amounts based on the maximum maintenance loan allowance.

Why are my student finance payments split?

If you’re wondering why your maintenance loan doesn’t come in one big lump sum - it’s for your own good! Student finance splits the annual amount into three to prevent students from spending it all within the first term - it may seem a little OTT, but it’s definitely a wise decision.

This isn’t to say you shouldn’t treat yourself, though - but while you’re at it, make your money go further by bagging yourself the best student discounts when you sign up with TOTUM. You won’t regret it!

What is the average maintenance loan?

According to the Higher Education Policy Unit (HEPI) In the 2023/24 academic year, the average maintenance loan paid to students in England was £7,590.

This may give you a rough idea, but remember your own student finance will be calculated based on your personal circumstances.

What is the maximum maintenance loan?

According to the Gov UK website, the maximum maintenance loan for the 2024/2025 academic year was £10,227 for students living away from their parents outside of London, £13,348 for those living away from their parents in London and £8,610 for students living with their parents. These figures are still correct as of August 12th 2025, but may be updated for the 2025-2026 academic year soon.

Can you get a maintenance loan for Open University?

It's unlikely that you'll be able to get a maintenance loan if you’re studying for a distance learning degree from the Open University or another provider, unless a physical disability prevents you from attending in person.

How to find my student finance payment dates schedule

To find your payment schedule and the status of your student finance payments, you should follow these steps:

Sign in to your account at www.gov.uk/student-finance-register-login

Click ‘Undergraduate student finance applications’

Select the relevant application

Below the heading ‘Manage your student finance’, click ‘View your payments’

Here, you’ll be given updates on your payments. If the status says ‘Scheduled’, ‘Ready to be paid’, ‘Payment in progress’, or ‘Paid’, you can expect to receive your maintenance loan soon.

If the status says ‘Blocked’, ‘Cancelled’, ‘Failed’, ‘Suspended’ or ‘Withdrawn’, you will need to take further action by contacting Student Finance.

To begin receiving your student finance payments, you must ensure you’ve registered/enrolled on your course.

When do I start repaying my student loan and how much is student loan repayment?

You’ll start repaying your student loan - both your tuition fee loan and your maintenance loan - when you earn over a certain salary threshold depending on which student loan plan you are on.

The earliest you’ll start repaying your student loan is:

the April after you leave your course

the April 4 years after the course started if you’re studying part-time and your course is longer than 4 years

April 2026 if you’re on Plan 5

Student Loan Plan 1

If you’re on Plan 1 (you started an undergraduate course in the UK before 1st September 2012), you can expect to begin repaying your student loan once your income is over £501 a week, £2,172 a month or £26,065 a year (before tax and other deductions).

Student Loan Plan 2

If you’re on Plan 2 (you started an undergraduate course in the UK between 1st September 2012 and 31st July 2023), you’ll only repay when your income is over £547 a week, £2,372 a month or £28,470 a year (before tax and other deductions).

Student Loan Plan 4

If you have taken out a Plan 4 student loan, you’ll only have to start repayments when your income is over £629 a week, £2,728 a month or £32,745 a year. Plan 4 student loans apply to Scottish students who started their undergraduate or postgraduate course in the UK on or after September 1, 1998.

Student Loan Plan 5

For those starting an undergraduate or advanced learner loan courses on or after 1st August 2023, you'll now be on Plan 5.

Those on Plan 5 student loans won't be expected to make any repayments until April 2026 at the earliest, even if you leave the course early and you’ll only repay when your income is over £480 a week, £2,083 a month or £25,000 a year.

Postgraduate Loan Plan

For anyone who's taken out a Master’s Loan or a Doctoral Loan, you’ll only begin repaying when your income is over £403 a week, £1,750 a month or £21,000 a year.

Basically, with all plans, you won’t be required to make any student loan repayments until you’re earning at least the stated income for your specific plan.

It’s important to note that the salary thresholds do get reviewed every year on April 6th, so the amount you pay back each month may change.

When it comes to how much your student loan repayment will be, those on Plan 1, Plan 2 and Plan 5 student loans will pay back 9% of the amount they earn over the salary threshold.

So, if you’re on Plan 2 and you earn £30,000 per year, you will repay around £20 per month towards your student loan. This should automatically be deducted from your pay.

When will I finish paying off my Student Loan?

The first thing to note is that although you may not have paid off the full amount, your repayments automatically stop if either:

you stop working

your income goes below the threshold

In good news, you won't have to pay your student loan off indefinitely - it gets written off after a certain period of time, that depends on when and where you attended university.

Will I be penalised for paying my student loan off early?

Definitely not! There is no penalty for paying all or part of your student loan off early.

Anyone can opt to make extra repayments towards their student loan, although remember that these are on top the repayments you have to make when your income is over the threshold amount for your repayment plan.

It's important to note that you cannot get a refund of any extra repayments you make, and also that it might not benefit you to make extra repayments because your loan will be written off at the end of the loan term. If you're unsure, it could be a good idea to speak to a financial advisor to weigh up the options for you.

When do Plan 1 Student Loans get written off?

When your Plan 1 loan gets written off depends on when you were paid the first loan for your course.

If you were paid the first loan on or after 1 September 2006 the loans for your course will be written off 25 years after the April you were first due to repay.

If you were paid the first loan before 1 September 2006 the loans for your course will be written off when you’re 65.

When do Plan 2 student loans get written off?

Plan 2 loans are written off 30 years after the April in which you were due to make your first repayment.

When do Plan 4 Student Loans get written off?

When your Plan 4 loan gets written off depends on when you were paid the first loan for your course.

If you were paid the first loan on or after 1 August 2007 the loans for your course will be written off 30 years after the April you were first due to repay.

If you were paid the first loan before 1 August 2007 the loans for your course will be written off when you’re 65, or 30 years after the April you were first due to repay – whichever comes first.

When do Plan 5 Student Loans get written off?

Plan 5 loans are written off 40 years after the April you were first due to repay.

If you can no longer work because of illness or disability

SLC may be able to cancel your loan if you claim certain disability benefits. You’ll need to provide evidence (for example a letter from the benefits agency) and your Customer Reference Number.

Join the TOTUM club!

Join TOTUM Student for FREE to access hundreds of student discounts on big-name brands like ASOS, Apple, MyProtein, boohoo, Samsung, and more!

Sign up for FREE, download the TOTUM app, and enjoy the latest offers, vouchers, coupons and more at your fingertips. Find out more.

Download The TOTUM App

Stories like this

Martin Lewis Confirms 'You'll Be Told' As Millions Set To Receive £700 Payment

Martin Lewis has confirmed that progress is being made on a compensation process that could finally see millions of people receive payments averaging around £700.

The Ultimate Student Discount Showdown: TOTUM vs. Student Beans vs. UNiDAYS – Which Is Truly the Best?

Welcome to the definitive guide on navigating the world of student discounts. If you're a student in the UK, your inbox and social media feeds are likely bombarded with offers from various platforms promising to save you money. - find out which is best!

The Professional’s Guide to the ‘Salary Stretch’: Why TOTUM+ is the Secret Weapon for Public Sector and Professional Workers

While many discount schemes offer a few percentage points off occasional purchases, TOTUM+ is built around daily utility. The core proposition is simple: Save an average of £550+ per year for an initial investment that starts from just £14.99.