The Apprentice Advantage: 7 Essential Ways Your TOTUM PRO Card Protects Your Budget During a Second Career

A New Chapter, a Familiar Struggle: The Financial Reality of the Adult Apprentice and How TOTUM Can Help

The Apprentice Advantage: 7 Essential Ways Your TOTUM PRO Card Protects Your Budget During a Second Career

A New Chapter, a Familiar Struggle: The Financial Reality of the Adult Apprentice

Taking the leap into a second career via an apprenticeship is a courageous and brilliant move. At 30, 35, or beyond, you are bringing years of professional experience, maturity, and a clear vision to your new path. However, unlike your younger counterparts, you are likely swapping an established salary for an apprentice’s wage while retaining substantial adult financial commitments: a mortgage or rent, car payments, and potentially family costs.

Research confirms this is a common struggle: career changers often face a significant temporary income drop—one study suggesting an average reduction of over £3,700 in the first year alone. Managing this “financial penalty of reskilling” requires precision, discipline, and, most importantly, the right tools to stretch every pound.

This is where the TOTUM+ card becomes your most essential financial asset.

The TOTUM+ membership is specifically designed for the professional learner—the re-skiller, the adult apprentice, the person committed to lifelong learning. It is not just about fashion or pizza; it’s about accessing high-impact, essential savings that directly offset the cost of adult life. Our focus here is on the Home & Finance category, the bedrock of any successful household budget. By mastering these discounts, you can mitigate the income drop, stabilize your financial footing, and focus fully on mastering your new career.

This guide details seven crucial ways you can leverage your TOTUM+ discounts in the Home & Finance category to protect your budget, save thousands, and ensure your career change remains sustainable.

1. Rebuilding Your Financial Foundation: The Power of Switching Incentives

When transitioning careers, you need a bank that recognizes and rewards your responsible adult history, rather than treating you like a standard student. The right banking partner, coupled with smart incentives, can inject hundreds of pounds directly into your reskilling budget right away.

The biggest opportunity for immediate, zero-effort savings lies in taking advantage of switching bonuses—deals TOTUM+ members can often access directly.

The Immediate Cash Injection

Many of our members benefit significantly from bank switching offers. For instance, TOTUM+ often highlights current account switching incentives, such as those offered by high-street banks like Santander or First Direct.

Santander Current Account Incentives:

You might find offers like earning £200 cash when switching to an eligible account (such as the Santander Edge Up or Edge Current Account). For an adult apprentice, this is not a small perk—it's a direct reimbursement for essential bills. The Edge accounts also frequently include cashback on selected household bills and essential spend, turning unavoidable costs (like council tax or utilities) into savings.

First Direct Welcome Bonus:

Switching offers often include a substantial welcome bonus, such as £175 cash from First Direct.

These welcome bonuses are pure profit for your budget, directly offsetting training costs or covering unexpected household expenses that would otherwise be a major stressor on an apprentice wage. We are talking about potential savings of over £300 in the first month alone, simply by performing a financial administration task you may have been putting off.

Mastering Digital Finance

The 30-35 cohort is also highly attuned to modern digital banking. TOTUM+ has also promoted incentives with digital banking services like Revolut, offering a sign-up bonus when opening an account. Digital banks are fantastic for career-changers because they offer:

Budgeting Tools:

Easy-to-use apps that help you monitor spending and stick to your strict apprentice budget.

Zero-Fee Overseas Spending:

Crucial if your apprenticeship involves any international travel or purchasing specialized resources from abroad.

Cashback Stacking:

Using digital cards alongside TOTUM's own cashback features maximizes every transaction.

Action Point: Treat bank switching like a paid project. It's a quick, high-reward task that yields immediate, tax-free income to stabilize your budget during your lower-earning apprenticeship phase.

2. Kitting Out the Adult Home: Appliances, DIY, and Home Furnishings

Unlike a student moving into halls, the adult apprentice is often furnishing a long-term home, replacing broken items, or upgrading essentials with appliances that need to last. The high upfront cost of white goods, cleaning equipment, or furniture can derail a budget already tight from a reduced income.

This is where the Home & Finance discounts transition from "perk" to "necessity."

Big Ticket Kitchen and Cleaning Savings

Kitchen and cleaning appliances are not luxuries—they are non-negotiable parts of running an adult household. TOTUM+ offers significant brand-specific discounts in this area:

Ninja and Shark Savings:

These two brands dominate the high-efficiency kitchen and cleaning market, and TOTUM+ members frequently access Exclusive 9% off discounts, often including sale items. This is a massive advantage. If you need a new high-power vacuum from Shark (saving up to £130 in some event sales) or a new air fryer or blender from Ninja (with potential savings of up to £150 on kitchen equipment), that 9% saving can easily translate to £50-£150 instantly.

Premium Appliance Deals:

Beyond Ninja and Shark, look for offers from premium brands. Discounts on Sage Appliances (e.g. 12.5% Off over £250) are vital if you rely on quality equipment for quick, healthy meals between work and study. Similarly, look out for discounts on LG home appliances (often around 20% off selected items) or deals from AO, which frequently offers £15 off large kitchen appliances over £299.

This means a planned £500 appliance purchase immediately drops to under £455 with a 9% discount—money you can redirect to your travel fund or study materials.

Furnishing and Decorating on a Professional Budget

Whether you are carving out a dedicated home-study space or finally tackling that overdue DIY project, your membership provides crucial savings on home furnishings and improvement:

The Range:

Discounts like 10% Off Orders Over £40 are perfect for those essential, medium-sized home items—storage, bedding, or basic furniture pieces to make your workspace comfortable.

DIY Essentials:

Keep an eye out for discounts with retailers like B&Q. While specific offers vary, finding £5 off first orders over £30 for club members, or similar perks, adds up when you’re buying tools, paint, or materials for necessary home maintenance.

Specialty Items:

Retailers like Christow or those offering office furniture discounts (e.g. Office Furniture Online) allow you to save on specialty items needed to create a conducive learning environment, such as ergonomic chairs or dedicated desks.

Key Insight: By front-loading your high-cost essential purchases with these discounts, you can significantly reduce your financial stress profile for the rest of your apprenticeship. Never pay full price for something that is a requirement of adult life.

3. The Adult Essentials: Insurance, Utilities, and Risk Mitigation

The 30-35 apprentice often has more assets to protect—a vehicle, a home, and perhaps even established travel habits. Insurance and essential services are typically your largest unavoidable bills outside of rent/mortgage and food.

Your TOTUM+ card provides crucial access points to these savings, turning necessary risk mitigation into a savings opportunity.

Car and Home Insurance Savings

While TOTUM does not sell insurance directly, it partners with major comparison sites and providers to ensure you are finding the best deal while gaining an extra perk:

Comparison Site Bonuses:

Promotions through platforms like MoneySuperMarket sometimes offer a chance to win vouchers (e.g., EasyJet vouchers worth £2,000) when purchasing Home or Car Insurance. Even without a direct discount percentage, comparison is vital, and these added bonuses sweeten the deal.

Breakdown Cover:

If you rely on your car for your commute or family duties, a breakdown is a major financial risk. Accessing 20% off Annual Breakdown Cover through partners like Start Rescue is a must-have for peace of mind and significantly cheaper than paying for an emergency recovery.

Travel Insurance Protection

As an adult learner, your travel insurance needs may be more complex, especially if your apprenticeship includes any travel component or if you are planning family holidays around term breaks. Admiral deals offering 10% off travel insurance policies are a practical, recurring saving that protects your financial stability while allowing you to enjoy your limited time off.

Mindset Shift: Think of your insurance and essential service discounts as "risk-adjusted savings." You are not just saving 10% on a premium; you are protecting your new career path from financial collapse due to an unexpected event.

4. Family and Finance: Supporting Your Dependents on an Apprentice Wage

One of the greatest pressures on the adult apprentice is balancing the apprenticeship income with the financial needs of dependents. Unlike younger students, many in the 30-35 cohort are parents. The financial struggle to maintain family quality of life during a career transition is real.

TOTUM+ offers specific, targeted relief for parents.

Essential Family Savings with Kids Pass

The single most relevant discount for parents is the potential to Earn 8% Cashback at Kids Pass through TOTUM Cashback. This is an enormous saving lever:

Days Out and Activities:

Kids Pass provides substantial discounts on theme parks, zoos, cinemas, and dining. By purchasing a Kids Pass subscription (or similar family leisure membership) through the TOTUM Cashback system, you immediately earn 8% of the purchase price back.

Stackable Savings:

This cashback applies to the initial purchase of the membership. However, once you have the Kids Pass membership, you unlock further deep discounts on all family activities throughout the year. This effectively makes family leisure time affordable, ensuring that your career change doesn't mean your children miss out.

The Power of Cashback for Groceries and Home Bills

The integrated TOTUM Cashback feature is critical for the adult apprentice feeding a household:

High-Volume Spending:

While we listed general food savings earlier, the Home & Finance budget is heavily impacted by weekly grocery costs. By using the TOTUM Cashback pre-pay card at major retailers (like Sainsbury's, Asda, M&S, B&Q, Argos, etc.), you earn a percentage back on every single transaction.

The £100s Challenge:

When a family spends £100-£150 a week on groceries and household goods, earning an average of 5% cashback can equate to £5–£7.50 back per week. Over a year, this easily builds up to hundreds of pounds - a tangible figure that proves the long-term, passive value of your TOTUM+ membership. This is money that flows back to you simply for purchasing essentials you were going to buy anyway.

Financial Planning Note: Integrate the cashback card into your weekly shopping routine immediately. The passive, cumulative savings are one of the best defences against the income dip.

5. Mastering the Dual Role: Workspace, Learning, and Financial Admin

The final frontier in Home & Finance savings involves optimizing your study environment and simplifying your financial administrative life—the less stress on your budget and time, the more you can devote to your new qualification.

Home Office Optimization

The career-changer is often undertaking a Higher or Degree Apprenticeship that requires extensive remote study. Your comfort and productivity directly impact your academic success.

Furniture and Setup:

Utilize discounts at retailers like Office Furniture Online or The Range to secure a professional workspace. Whether it's a small discount on a chair or a larger saving on a new desk, investing in your study environment protects your back, your focus, and ultimately, your investment in the apprenticeship.

Office Supplies:

Keep an eye out for deals on office supplies, printers, and accessories that fall under this category. A comfortable workspace is an investment, not an indulgence.

Simplifying Financial Admin

Your time is your most precious resource. Between work, study, and family, financial management needs to be streamlined.

Financial Apps & Tools:

Many TOTUM-affiliated brands, including digital banks and financial services, offer seamless app integration for tracking spending, setting budgets, and automating savings. Use the discounts to try new tools that save you time, turning hours of manual budgeting into minutes of review.

The Power of Clarity:

By using a dedicated system like TOTUM Cashback for essentials, you automatically segment your spending and gain immediate clarity on where your money is going, helping you identify and eliminate unnecessary costs quickly.

The TOTUM+ Advantage: Your Financial Co-Pilot for Success

Switching careers later in life is a strategic choice, but it requires a strategic approach to personal finance. The temporary income drop is the single biggest barrier to success and peace of mind for the adult apprentice.

The TOTUM+ card is your co-pilot through this transition. It moves beyond superficial student savings to target the massive, immovable financial commitments of adult life: your home, your family, your vehicles, and your banking. By leveraging the comprehensive range of discounts in the Home & Finance category—from the £200 bank switching bonus and the 9% off your new Shark vacuum, to the £100s you’ll save on groceries via Cashback—you are not just getting deals; you are funding your future.

Stop letting your necessary adult expenses erode your apprentice salary. Start using the discounts specifically designed for you, the serious, committed, professional learner.

Your success in your second career depends not just on how hard you work, but how smart you save.

Ready to Stabilize Your Budget?

If you are an Intermediate, Advanced, Higher, or Degree Apprentice, or a professional learner pursuing a recognised qualification, you are eligible for the card built specifically for your journey.

Join TOTUM+ today and secure your financial foundation for your second career.

Join the TOTUM club!

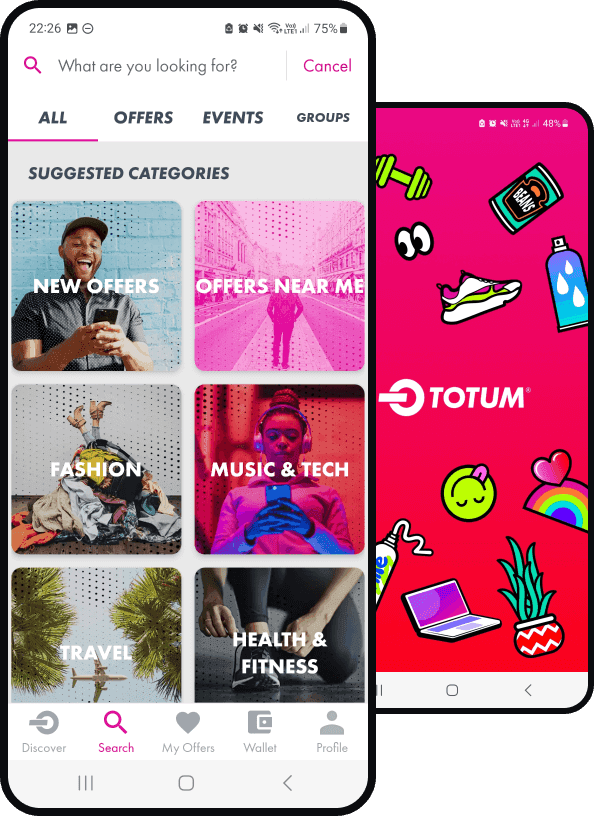

Join TOTUM Student for FREE to access hundreds of student discounts on big-name brands like ASOS, Apple, MyProtein, boohoo, Samsung, and more!

Sign up for FREE, download the TOTUM app, and enjoy the latest offers, vouchers, coupons and more at your fingertips. Find out more.

Download The TOTUM App

Stories like this

What the 2025 Budget Means for Students, Apprentices & Professionals

If you’re studying, working an apprenticeship, or simply trying to figure out what’s next, there are some big changes that are worth knowing about.

Martin Lewis Says 5 Million People Born Between 1985 And 2003 Could Be In For Pay Day

Martin Lewis has issued a public service announcement to anyone born between 1985 and 2003, revealing that up to five million people in the UK could be due some cash...

Putting Up Your Christmas Decorations Early Could Make You Happier, Psychotherapist Says

It turns out that putting your Christmas decorations up early could actually be a mood booster!